Kuwait Finance House

Pioneering a digital transformation.

Defining a customer experience strategy for one of the world’s leading Islamic financial institutions.

Kuwait Finance House (KFH) is considered a pioneer in Islamic Finance or Sharia Compliant Banking. The first Islamic bank established in 1977 in the State of Kuwait, today, it’s one of the leading Islamic financial institutions in the world. Continuing in the pioneering tradition, KFH asked us to help define its customer experience proposition, and shape a new branch experience to help customers make the most of its digital banking platforms.

What we delivered

– Customer segmentation and personas

– CX proposition

– User journeys

– Branch design

– Branch communications

Delivering on a clear mission

KFH has a clearly stated mission: To deliver superior innovation and customer service excellence. Recognising the opportunity to turn KFH’s extensive branch network to its advantage, Industry helped redefine the role of a branch for the digital era.

Migrating many simple in-branch services online, the new approach sees wait times reduced, increased customer satisfaction and the migration of customers to alternative channels where appropriate. This creates more space in the branch environment for consultation, improving the feeling of personal service.

A clear customer experience proposition

Industry helped KFH arrive at a clear customer service model with a clear proposition at its heart: Banking shaped around you.

Customer segmentation and journey mapping

We explored the needs of different customer types – from time poor executives, to those enjoying a leisurely retirement.

We mapped out a series of end-to-end customer journeys, looking at the integration of digital and in-branch touchpoints to create a seamless experience that looked to increase efficiency, without reducing quality.

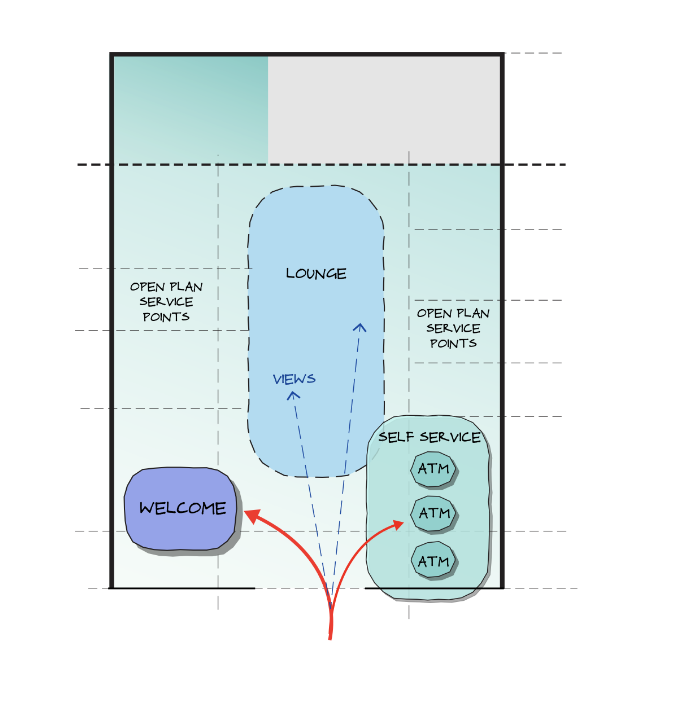

A radical new branch design

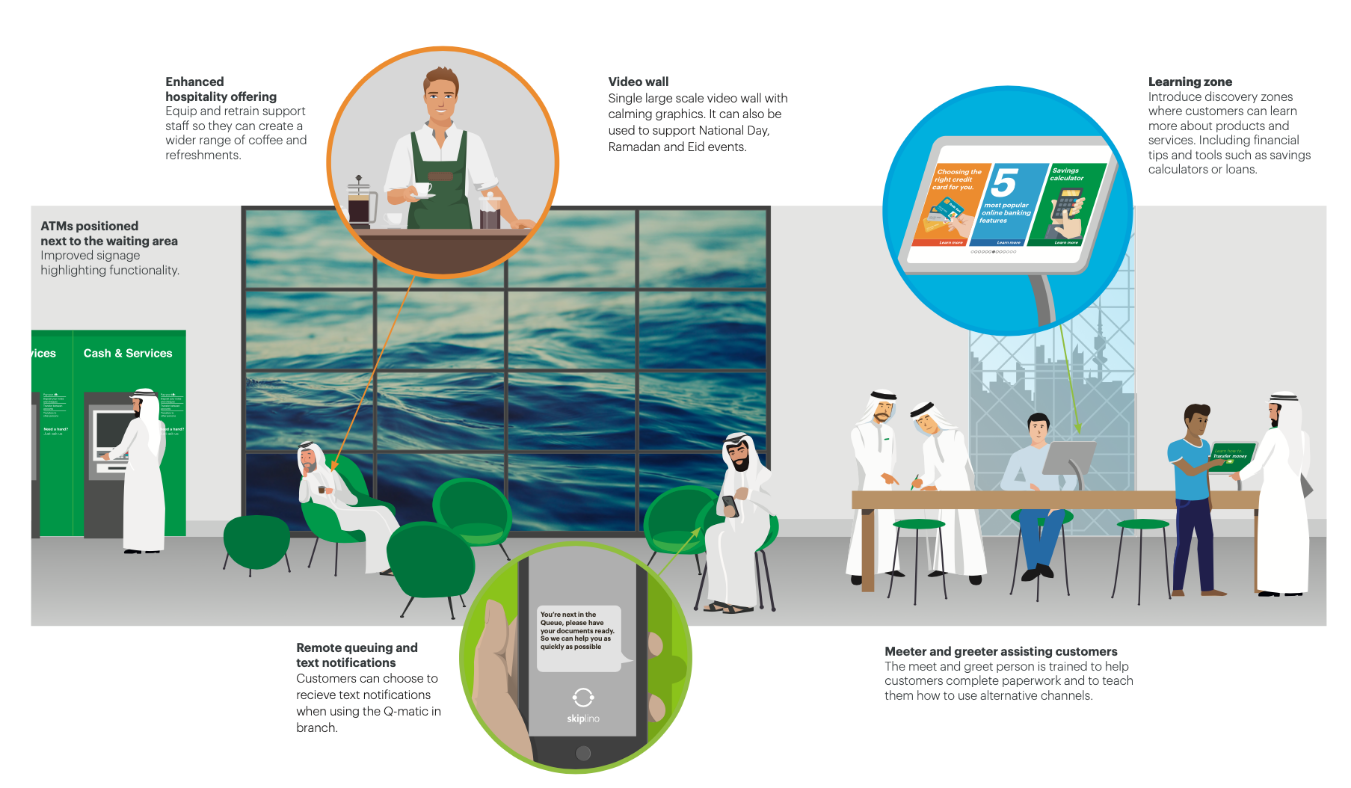

Working with our architectural partner FDP, we created a new modular branch design to bring the experience to life and showcase KFH’s digital capability.

Large digital walls were introduced providing ambient background landscapes. Digital touchpoints provided a way for staff to demonstrate the power of the new digital channels to perform a wide range of banking transactions, while digital signage and queue systems were introduced to ensure smoother customer flows through the branch.